|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

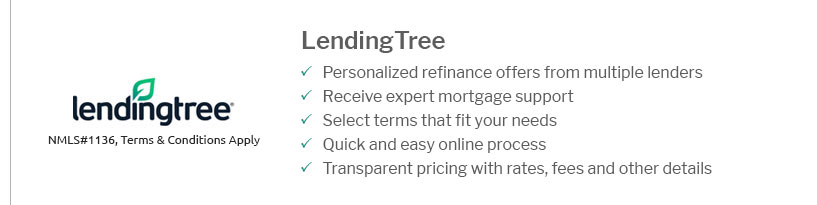

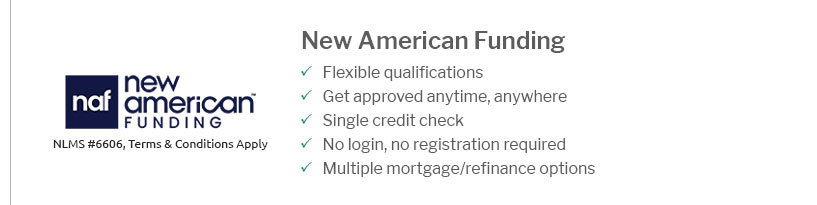

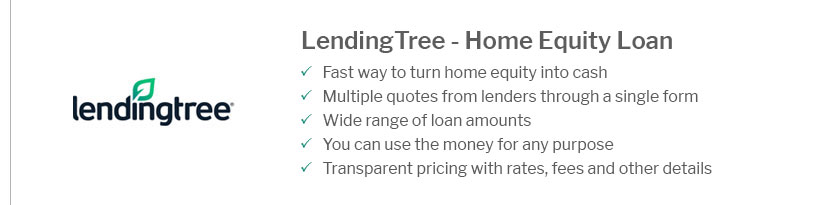

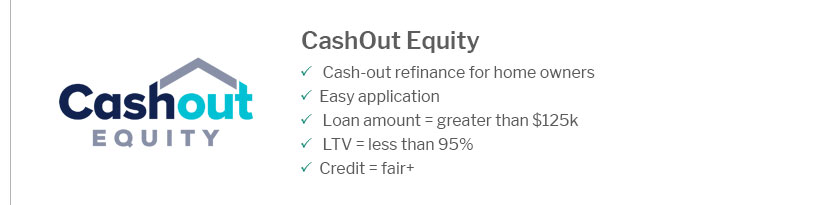

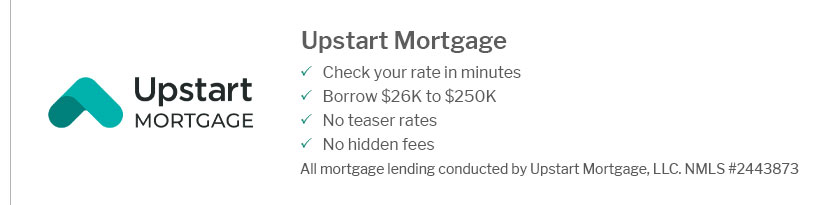

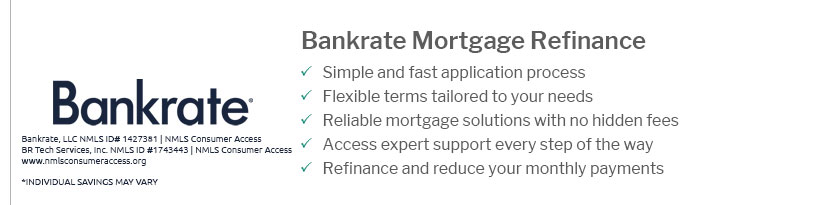

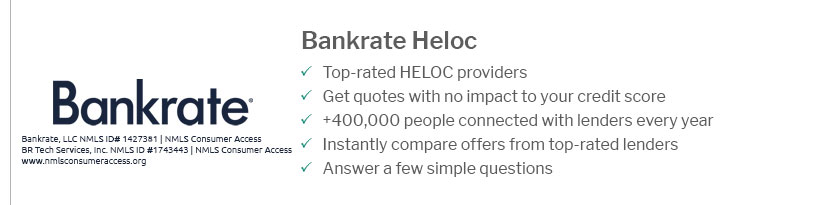

Best 5 1 Arm Refinance Rates: A Comprehensive Guide for 2023Choosing the right 5 1 ARM refinance rate can be a daunting task. This guide will provide a detailed analysis of the best options available in 2023, helping you make an informed decision. Understanding 5 1 ARM LoansA 5 1 ARM loan is a hybrid mortgage that offers a fixed interest rate for the first five years, followed by a variable rate. It's a popular choice for borrowers looking for lower initial payments. Top 5 1 ARM Refinance RatesBelow, we outline the top refinance rates available this year.

Factors Influencing Refinance RatesEconomic IndicatorsInterest rates are influenced by various economic factors, such as inflation and employment rates. Credit ScoreYour credit score plays a crucial role in determining the refinance rate you qualify for. Steps to Refinance Your HomeRefinancing involves several steps, from understanding your financial situation to closing the new loan.

FAQs About 5 1 ARM Refinance RatesWhat is a 5 1 ARM loan?A 5 1 ARM loan is an adjustable-rate mortgage that features a fixed rate for the first five years, followed by a variable rate. How can I get the best refinance rate?To secure the best rate, maintain a high credit score, compare different lenders, and understand the terms of your refinance options. Is refinancing a good option for everyone?Refinancing is not suitable for everyone. Consider your financial goals, current interest rates, and how long you plan to stay in your home. What are the costs involved in refinancing?Refinancing costs can include application fees, appraisal fees, and closing costs. These can vary depending on the lender. Can I refinance a rental property?Yes, refinancing a rental property is possible. Learn how to refinance a rental house here. https://www.nerdwallet.com/mortgages/mortgage-rates/5-1-arm

It used to be called the 5/1 ARM because it was adjusted annually before ... https://www.navyfederal.org/loans-cards/mortgage/mortgage-rates/adjustable-rate-mortgages.html

You'll generally make a lower payment for the first 5 years of a 5/5 ARM loan than if you refinance with a ... https://money.usnews.com/loans/rates/mortgages/5-1-arm

Current 5/1 ARM Mortgage Rates ; Bison State Bank. NMLS #757416. 4.8 - 6.49% - 6.584% ; Farmers Bank of Kansas City. NMLS #613839. 4.7 - 6.49% - 6.587% ; First Federal ...

|

|---|